Why Is The 10-Year U.S. Treasury Yield Still Sub-3%?

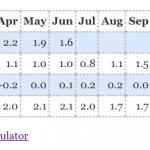

The two-pronged Federal Reserve mandate is to control inflation within a pre-determined range and maximize U.S. employment! And from all observations the economy is fulfilling both with the unemployment rate reported July 2018 at 3.9% and the July CPI rising .2% with an annual increase in the core rate of 2.4%. If the economy is […]