With the passage of the ‘Tax Cuts and Jobs Act’ (name subject to change) some aspects of the legislation are very clear and some things will take some time to play out such as real estate valuation!

So what do we know concerning the tax bill?

There are seven tax brackets as there were before, the standard deduction has increased to $24,000 for joint filers, the child tax credit has increased to $2,000, the mortgage interest deduction for new originations has been capped at $750,000, the corporate tax rate will decrease to 21% and more.

And of great importance particularly to residents in high-tax states such as New York, New Jersey and Connecticut, state and local tax deductions or SALT have been capped at $10,000.

The reason this cap will be so significant for some in these high-tax states is based on the following statistics concerning the percentage of homeowners who pay more than $10,000 in property taxes:

Connecticut: 13% pay more than $10K in property taxes

New York: 19% pay more than $10K in property taxes

New Jersey: 30% pay more than $10K in property taxes (Source: Forbes)

High-Tax States And Property Taxes – What Don’t We Know?

So that said, what are some things that remain unclear about the fact that so many in the states highlighted above will be disadvantaged by the new tax bill, at least in terms of property tax deductibility?

And further, in New York State, will the potential impact on real estate be exacerbated by the fact that so many of these tax disadvantaged homeowners are concentrated in the downstate region (Long Island, New York City, Westchester)?

A few questions that come to mind…

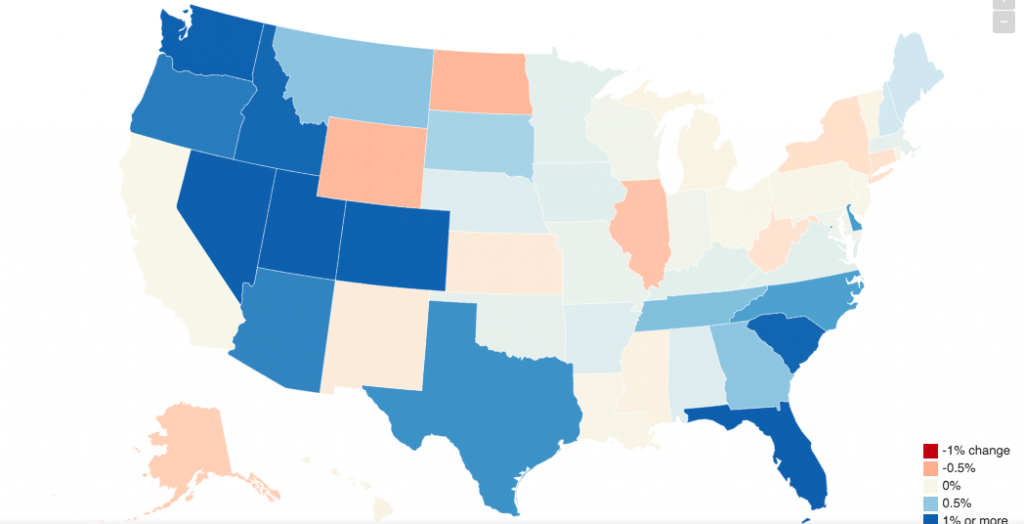

- The first question that comes to mind is what number of homeowners, if any, will take the new tax bill as a sign that it’s time to move to states that have far less egregious property tax levels?

- The second question is whether the political leaders in these high-tax states will ‘get religion’ and work to cut expenditures so that the tax levy in so many of their jurisdictions can be brought under control? And, with the degree of going-forward expenses they face such as pension liabilities that in many instances are already underfunded, are budget cuts even possible (Connecticut pensions 52% funded, New Jersey 60% funded, New York well funded at 98% but 0% funded in terms of other post-employment benefits Source: Mercatus)?

- Third and on a more local level, in lieu of raising property taxes just how high can entities like Nassau and Suffolk Counties in New York increase fees on items such as recording documents (Nassau County, New York Is At It Again! New Fee Proposal On The Table To Gouge The Real Estate Industry…Or,)?

- Finally, what impact will property tax levels combined with deductibility restrictions combined with potential supply factors in terms of houses coming onto the market have on home prices and by extension banks who may face collateral issues?

As we’ve said in this space many times in the past, we will have to wait and see when the potential impact of this tax legislation becomes reality!

Michael Haltman, President

Hallmark Abstract Service

(646) 741-6101, mhaltman@hallmarkabstractllc.com