Photo by Spencer Means

If the business or entity you are responsible for running needs to raise its top-line revenue number, in the hopes of potentially improving the bottomline number, what can be done?

Simple! The business could simply raise prices being charged the consumer for the product(s), right?

Of course that answer in many cases is not feasible, as there are typically competitors for products, with an increase in prices having the real potential of cutting into sales as prices would no longer be competitive. In-other-words the potential for the exact opposite result from the one desired.

So for a business in the private sector, if raising prices or expanding into new markets is not possible, there are of course other ways to improve the bottomline, including cutting costs.

After all business leaders need to make tough fiscal decisions or, if not, face the prospect of going out of business.

But what about a government that needs to raise revenue in order to balance its budget, at least on paper?

Cutting costs is sometimes mentioned in passing and for-the-most-part never done. The easy tool is to raise revenue in the form of taxes, or as taxes disguised as fees.

And often governments will try to target smaller constituencies (the low-hanging fruit) for the revenue raise. A group that may not generate much sympathy, or interest, among the general citizenry.

Tax Map Verification Letter in Nassau County, New York

As an example of fees created for the sole purpose of raising revenue, often in a regressive way, consider the Nassau County Tax Map Verification Letter that in 2015 was instituted at $75 for many of the documents required to be recorded after a real estate closing. If there is a deed and a mortgage being recorded, that’s two separate letters at $75/per.

In 2017 the $75 fee was raised to $355 per letter! For the aforementioned deed and mortgage the cost rose from 2X$75, to 2X$355! And often more than two documents need to be recorded.

An egregious money grab by Nassau County no doubt, but because fewer people are affected compared to a raise in property taxes, the outcry while loud was short-lived.

This 2017 article from the Hallmark Abstract Service blog tells the story, ‘Nassau County, New York Is At It Again! New Fee Proposal On The Table To Gouge The Real Estate Industry…Or,‘.

Current New York State Budget, Waiting for the Governor Cuomo’s Signature

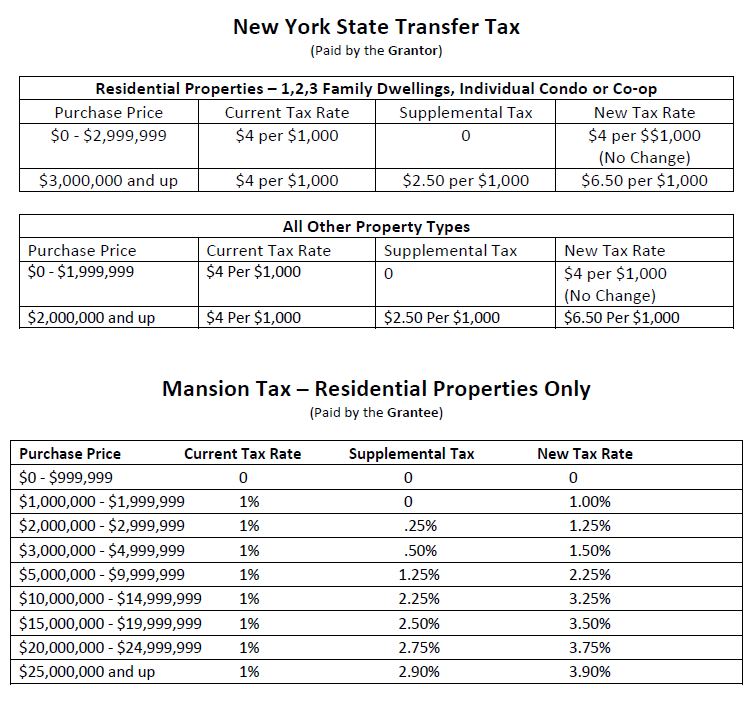

The alert below from the New York State Land Title Association describes the proposed tax increases in the NYS budget, covering the Transfer Tax and the Mansion Tax and affecting real estate in the New York City luxury market.

In a real estate transaction one is the responsibility of the seller and one the buyer and, given the dollar amount of the transactions, few if any of the states non-affected citizens will likely care that much.

The reality, however, is that as the NYS tax burden increasingly becomes more oppressive, it will ultimately impact all of us as citizens flee to lower tax states and fewer from other states will choose to move to New York!

Proposed New York State Tax Increase Example

Summarizing the effect, for a buyer and seller of a New York City residential property…

Consider the sale of a $3,500,000 residential property in Manhattan:

For the seller, the NYS Transfer Tax liability will rise from $14,000 ($4 per $1,000) to $21,875 ($6.50 per $1,000),

For the buyer, the New York State Mansion Tax will rise from $35,000 (1%), to $52,500 (1.5%).

|

Google+

Pingback: Easy Reference Guide to the New York State Transfer Tax and Mansion Tax Hikes… | Hallmark Abstract LLC

Pingback: July 1, 2019 New York State and New York City Real Estate Taxes Slated to Rise! | Hallmark Abstract LLC

Pingback: Mortgage Tax Expansion: New York’s Commercial Real Estate Industry Is In The Crosshairs! | Hallmark Abstract LLC