With the 10-year treasury crossing below .75% this morning, potential homebuyers and those on the fence about refinancing may hop off, and pursue a mortgage loan!

In other words, with rates at current levels are banks and other lending institutions offering borrowers the opportunity to basically ‘pick money off of the proverbial money tree’?

Perhaps they are! First-time homebuyers, those trading-up to their second home or, with rates so low, buyers who might be looking to buy a vacation home that in New York City also goes by the name pied-à-terre, are attempting to borrow at historically attractive mortgage rates.

As a current homeowner with a mortgage on your property that was obtained when mortgage rates were higher (which could actually be only a month or two ago), you want to do an analysis about whether a mortgage refinance makes good financial sense.

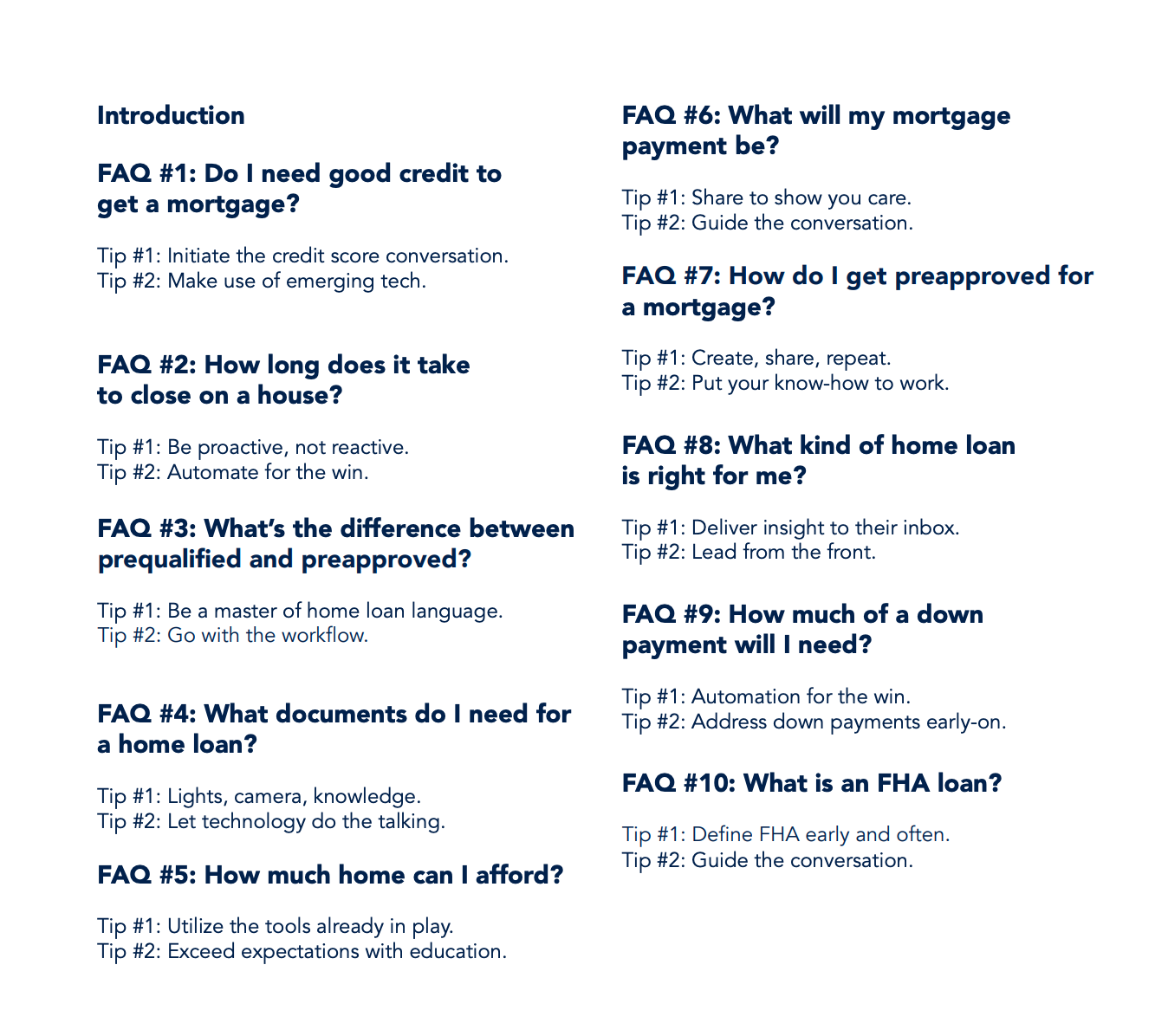

The information below concerning the Top 10 questions that a mortgage loan originator gets asked provides some great information, with a link to the full report provided and written by National Mortgage News.

While the report is geared to loan officers in terms of the ways to address these questions, it is fantastic information for the borrowing public as well.

Note: If any potential borrower need an introduction, depending on their specific loan scenario, to a mortgage loan expert who can help, Hallmark Abstract Service works with many and would be happy to share them with you!

The Top Ten Mortgage FAQs

Question in New York about title insurance and how you can likely save money on your closing costs with Hallmark Abstract Service, reach out to us at info@hallmarkabstractllc.com.

Buying a Property in New York? Remember You Have the RIGHT to Choose Your Title Insurance Provider!

Google+